The Facts About Credit Card Processing Companies Revealed

Wiki Article

Merchant Services Things To Know Before You Get This

Table of ContentsFacts About Credit Card Processing Companies UncoveredA Biased View of Payment HubExcitement About Online Payment SolutionsThe 2-Minute Rule for Online Payment SolutionsSome Of Online Payment SolutionsThe 9-Second Trick For Merchant Services

Have you ever before wondered what occurs behind the scenes when an on the internet repayment is made? If you are just starting with business of e, Commerce and on the internet repayments or if you are merely interested concerning the process it can be testing to navigate the convoluted terminology made use of in the sector and also make sense of what each star does as well as exactly how.

A merchant is any type of individual or business that sells goods or services. An e, Business seller refers to a party that markets products or solutions with the Net.

You're probably questioning what an obtaining financial institution is well, it's a bank or banks that is a signed up participant of a card network, such as Visa or Master, Card, and accepts (or acquires) deals for merchants, on part of the debit and also charge card networks. We'll cover this in more information later in this blog post - credit card processing.

Facts About Square Credit Card Processing Revealed

A for a particular vendor. This account number is similar to other one-of-a-kind account numbers provided by a financial institution (like a bank account number), yet is especially used by the vendor to determine itself as the proprietor of the deal information it sends to the financial institution, as well as the recipient of the funds from the purchases.

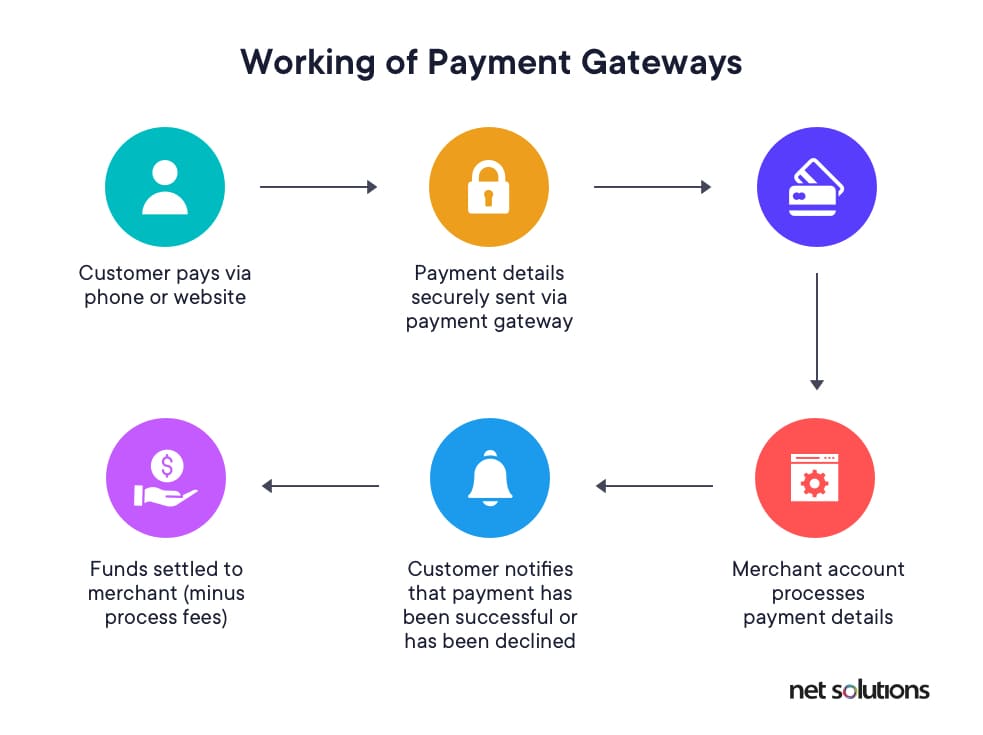

Once the vendor has actually acquired a merchant account, whenever a consumer acquisitions an item with a credit or debit card, the vendor submits the purchase transaction information to the payment processor made use of by its getting bank by means of a repayment portal. A settlement portal is a software application that promotes the communication of transaction details.

More About Credit Card Processing Companies

The (e. g. in the situation of American Express) or speak to the card's releasing financial institution for permission try these out (in the situation of Visa/Master, Card). A releasing financial institution is any financial institution or financial establishment that grants (or issues) debt or debit cards, with card organizations. How Does an Issuing Financial Institution Work?An acquiring financial institution is a financial institution or banks that approves debit or charge card transactions for a cardholder. Exactly how Does an Acquiring Bank Work? Acquirers/Acquiring banks are registered participants of a card network, such as Master, Card or Visa, and also approve (or obtain) deals in support of those debit and also bank card networks, for a seller (payment hub).

Whenever a cardholder makes use of a debit or credit history card for a purchase, the acquiring bank will certainly either approve or decrease the transactions based payment processing solutions on the details the card network as well as issuing bank have on document regarding that card holder's account. In addition to handling transactions, an acquirer also presumes full threat and also duty linked with the transactions it processes.

The Of Credit Card Processing

The issuing financial institution then connects the result (approved/declined) as well as the factor for it back to the repayment processor, which will certainly in turn communicate it to the merchant and consumer with the settlement gateway. If the deal is accepted, then the quantity of the transaction is subtracted from the card owner's account and the cardholder is provided an invoice.The following step is for the seller to satisfy the order put by the buyer. After the seller has fulfilled the order, the issuing bank will certainly clear the authorization on the shopper's funds and prepare for transaction negotiation with the seller's obtaining financial institution. Bank Card Interchange is the procedure in which an acquirer or getting financial institution submits approved card purchases on behalf of its sellers.

The 10-Second Trick For Payment Solutions

The getting bank then sends purchase settlement demands to the customers' issuing financial institutions entailed. Once all authorizations have been made and also all authorizations obtained by the entailed celebrations, the providing bank of the purchaser sends out funds to the vendor's obtaining bank, using that financial institution's payment processor.This is called a settlement pay or settlement. For regular card purchases, despite the fact that the authorization as well as authorization for order satisfaction take only seconds, the entire settlement processing circuit in the background can occupy to three days Read Full Report to be finished. And there you have it just how the repayments market functions, basically.

Discover around more terms and also ideas around on the internet payment handling by reading this total guide.

The Facts About Square Credit Card Processing Uncovered

Referred to as the cardholder's financial establishment. An Acquirer is a Visa/ Master, Card Affiliated Financial institution or Bank/Processor alliance that is in the business of refining bank card transactions for services as well as is constantly Acquiring new vendors. A merchant account has a range of costs, some periodic, others billed on a per-item or percentage basis.Report this wiki page